Building Partnerships for Disaster-Resilient Economies

Credit: Time U.S. Online

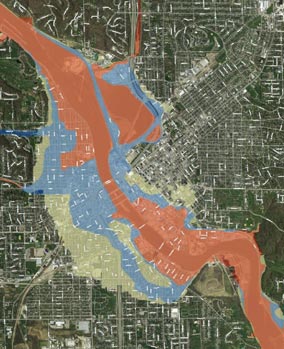

As extreme weather disasters become increasingly common, their impacts are being felt nationwide by communities large and small. These impacts can be particularly hard on businesses. Without the necessary preparation, businesses can suffer costly damage, be cut off from supplies, lose sales, and experience disrupted operations when disaster strikes. In some cases, they may even be forced to close permanently.

These dangers for local businesses also pose a ripple effect threatening the communities they support – by reducing income and jobs as well as access to critical goods and services.

In response to concerns about climate impacts, many local and regional governments are looking for ways to ensure that their economies remain healthy and functional – “resilient” – in the face of a changing climate.

Below are a few steps, highlighted at the conference, that local and regional leaders can take – in advance of disaster – to protect the economic assets in their community.

Build Partnerships with Your Business Community: Many businesses don’t have the time, resources or experience needed to prepare effectively for disasters. And post-disaster, when they lack access to capital, workforce options, technical assistance, insurance and a customer base, strong communication lines and relationships with government leaders can mean the difference between recovery and economic ruin.

Building strong relationships with businesses – and training businesses in resiliency and continuity measures – can help ensure that they have the support, contacts, resources and knowledge to respond quickly and effectively to disasters. Developing response plans is one element. For example, the East Central Iowa Council of Governments has provided continuity-planning assistance to businesses; and the Department of Homeland Security and FEMA launched ReadyBusiness in 2004 to provide business preparedness support.

Support Capital Improvements to Modernize Infrastructure: When infrastructure fails during a disaster, it can interrupt vital services. For example, in the short term, it can disrupt access to water and power, hamper the transport of people to safer areas and deny access to critical disaster relief goods and services such as hospitals, food and medicine.

Credit: Scott Olson, Getty Images

Resilient infrastructure helps ensure business continuity during and after disaster. For example, building underground power lines and a citywide fiber broadband network can help businesses get up and running quickly again – instead of waiting weeks or months for power and Internet connections to be restored afterwards.

Partnerships with State, Federal and Private Funders: Federal and state recovery support is available, but it can be hard and time-consuming to access. Without advance preparation to learn about and use available programs, resources and funds, you could spend months, if not years, filling out paperwork and applications and waiting to receive financial and other non-monetary support.

Advance preparation around this topic will allow local governments and businesses to apply for and access resources faster, thus encouraging a quicker recovery. Potential sources of financial support and resources to encourage business recovery include FEMA, the U.S. Economic Development Administration, Small Business Development Centers, modifying existing business assistance grants and programs (such as façade improvement programs), local and regional government reserves, and foundation funding.

Revolving loan funds also serve as a creative source of financing to support business recovery. For example, the East Central Iowa COG developed a Business Assistance Revolving Loan Fund to support business recovery after the 2008 floods. Loans can be used to purchase real estate and equipment and for working capital. The maximum loan amount is $250,000, with an average loan award of $50,000. As of September 2013, the fund had deployed 27 loans totaling more than $3 million. This funding leveraged an estimated $29.5 million from other sources. These efforts have created an estimated 325 new private-sector jobs, and saved another 327.

In times of disasters, partnerships and strong social networks are a key indicator of successful recovery – creating these connections in advance can increase your resiliency and better prepare your community to respond.

Session information and presentations available on the New Partners for Smart Growth website: “Using Smart Growth and Economic Strategies to Build Disaster Resilient Economies”

Local Government Commission Newsletters

Livable Places Update

CURRENTS Newsletter

CivicSpark™ Newsletter

LGC Newsletters

Keep up to date with LGC’s newsletters!

Livable Places Update – April

April’s article: Microtransit: Right-Sizing Transportation to Improve Community Mobility

Currents: Spring 2019

Currents provides readers with current information on energy issues affecting local governments in California.

CivicSpark Newsletter – March

This monthly CivicSpark newsletter features updates on CivicSpark projects and highlights.